China's photovoltaic power generation industry experienced rapid growth in 2013-2017 and experienced a low in the industry in 2018. The rapid braking of the 531 policy caused the domestic market to decline rapidly, product prices to decline rapidly, and corporate profitability to continue to be low. Plunge. However, affected by policies, the industry has gradually changed from the past extensive growth, the pursuit of scale to the refined development, and the pursuit of quality.

Steady increase in distributed market share

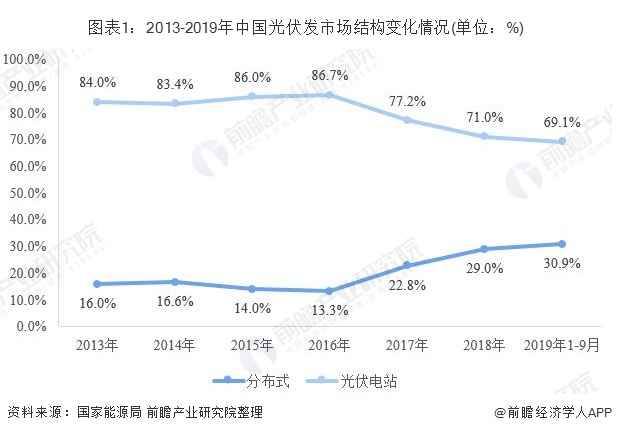

At the beginning of the development of photovoltaic power generation in China, photovoltaic power stations were vigorously developed in various places. In 2013, the cumulative installed capacity of photovoltaic power stations accounted for 84% of the installed capacity of photovoltaic power generation, which is in an absolute leading position.

Different from photovoltaic power stations, distributed photovoltaic power generation refers to photovoltaic power generation facilities that are constructed and operated at or near the user's site. They are mainly used on the user's own initiative, with excess power on the grid and balanced adjustment in the distribution network system. In recent years, the state has been actively encouraging distributed photovoltaic power generation systems and has introduced a series of support measures. The “Thirteenth Five-Year Plan” for electric power development issued at the end of 2016 set ultra-conventional development goals for distributed photovoltaics: “In 2020, installed solar power generation will reach more than 110 million kilowatts and distributed photovoltaics will exceed 60 million kilowatts.” With the advancement of distributed photovoltaic power generation in various places. The structure of China's photovoltaic power generation market has changed, especially since 2016, China's distributed photovoltaic market share has increased from 13.3% to 30.9%.

PV eastward process accelerates

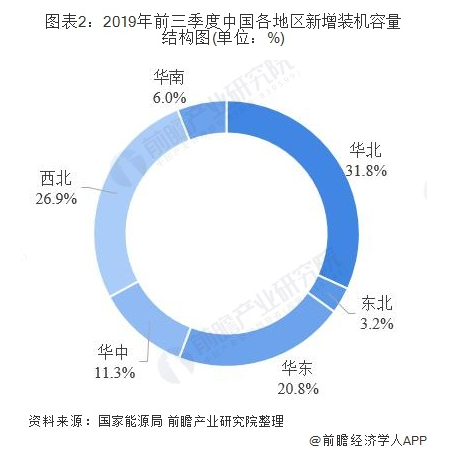

From the perspective of newly installed capacity, China ’s photovoltaic power generation has steadily advanced from west to east. In the first three quarters of 2019, the newly installed capacity in North China was 5.086 million kilowatts, accounting for 31.8% of the country; 3.2% nationwide; 3.322 million kilowatts of new installed capacity in eastern China, accounting for 20.8% of the country; 1.809 million kilowatts of new installed capacity in central China, accounting for 11.3% of the country; 4.308 million kilowatts of new installed capacity in northwestern China, accounting for 26.9% of the country; The newly installed capacity in South China was 955,000 kilowatts, accounting for 6% of the country's total.

Specific to each province, in the first three quarters of 2019, Shandong Province ranked first in terms of new installed capacity, reaching 1.8 million kilowatts; Qinghai and Zhejiang followed closely with new installed capacity of 1.5 million kilowatts and 1.38 million kilowatts, respectively.

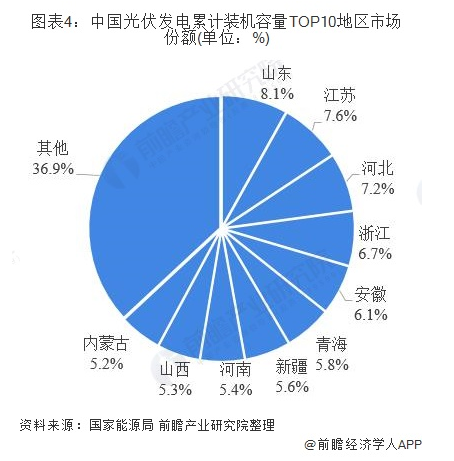

In terms of cumulative installed capacity, as of the third quarter of 2019, the cumulative installed capacity of photovoltaic power generation in nine regions in China exceeded 10 million kilowatts. Among them, Shandong ranked first with 15.41 million kilowatts, accounting for 8.1% of the country's total installed capacity; Jiangsu and Hebei followed closely with 14.45 million kilowatts and 1,363 watts, accounting for 73.6% and 7.2% of the national total installed capacity.

GCL New Energy's photovoltaic operation position is solid

With the implementation of the 531 photovoltaic new policy, the development of related companies in the photovoltaic industry, especially the construction and operation of photovoltaic power stations, has been hindered. Some private companies have begun to sell assets to seek "self-help". Domestic power station asset holders have also gradually shifted to capital Strong state-owned enterprises. As of the first half of 2019, GCL New Energy ranked first with 7.182GW of installed capacity; CECEP and Panda Green Energy followed closely behind with installed capacities of 4.69GW and 2.247GW, respectively.

Contact:Mr. Li

Phone:18123593880

Email:2105568730@qq.com

Company: Guangdong Jing Tian new energy electric power Co.,LTD

Add:One of the 2nd floor of Building 3, No. 2 Guangzhu Road, Nanyi Road, Nanjiang Neighborhood Committee, Daliang Street Office, Shunde District, Foshan